Structure of investors

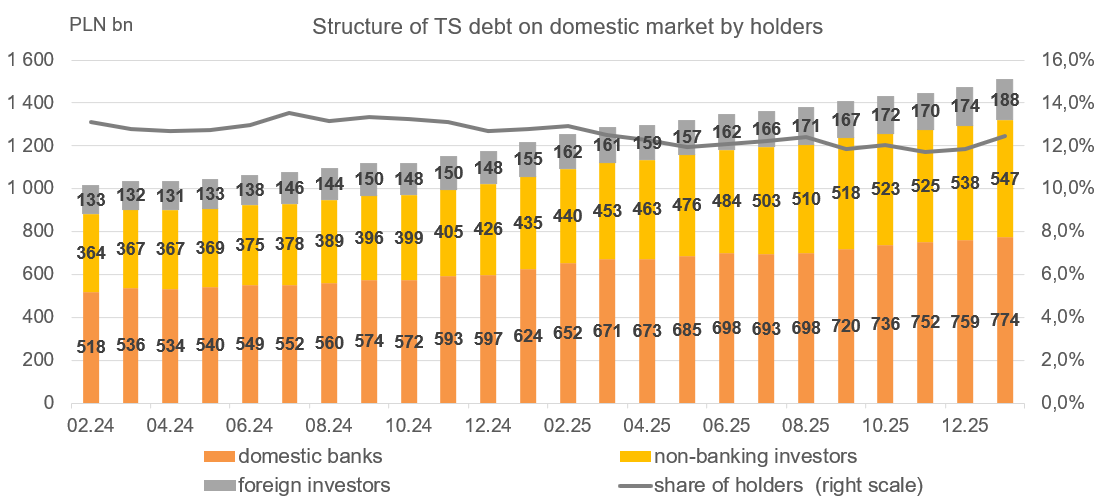

In January debt in domestic TS increased by PLN 37.9bn and amounted to PLN 1,508.7 billion. This was the result of an increase in debt towards all three groups of investors: domestic banks (including the NBP), domestic non-bank investors and non-residents by PLN 15.5bn (to PLN 774.1 billion), PLN 8.7bn (to PLN 546.5 billion) and PLN 13.7bn (to PLN 188.0 billion), respectively. As a result, the share of domestic banks (including the NBP) decreased to 51.3% from 51.6% in December (51.0% at the end of December 2024), while the share of domestic non-banking investors in the domestic TS debt decreased to 36.2% from 36.6% in the previous month (36.4% at the end of December 2024). However, the share of non-residents in the domestic TS debt increased to 12.5% compared to 11.8% in December (12.7% at the end of December 2024).

(A) The face value of Treasury Securities used as collateral of state budget deposits in commercial banks is presented in "Ministry of Finance" subcategory (within "General government institutions" category) and thus is deducted from the banking sector category.

| Nominal T-bonds and T-bills outstanding at the end of January 2026 (PLN million) | ||||

| T-bonds | T-Bills | Total | ||

| Banks | 730 179,02 | 28 693,52 | 758 872,54 | |

| Foreign investors* | 187 439,11 | 555,81 | 187 994,92 | |

| Insurance funds | 74 843,40 | 482,65 | 75 326,05 | |

| Pension funds | 33 687,81 | 0,00 | 33 687,81 | |

| Investment funds | 111 961,66 | 100,00 | 112 061,66 | |

| Households** | 181 044,44 | 0,00 | 181 044,44 | |

| Non-financial corporations** | 8 030,33 | 893,68 | 8 924,01 | |

| General government institutions | Total | 138 918,78 | 209,58 | 139 128,36 |

| Including MoF | 15 244,00 | 0,00 | 15 244,00 | |

| Others | 10 150,67 | 1 469,63 | 11 620,30 | |

| Total | 1 476 255,22 | 32 404,87 | 1 508 660,09 | |

(B) The face value of Treasury Securities used as collateral of state budget deposits in commercial banks was retained within "Banks" category and thus is not presented in "General government institutions" category.

| Nominal T-bonds and T-bills outstanding at the end of January 2026 (PLN million) | ||||

| T-bonds | T-Bills | Total | ||

| Banks | Total | 745 423,02 | 28 693,52 | 774 116,54 |

| Including MoF | 15 244,00 | 0,00 | 15 244,00 | |

| Foreign investors* | 187 439,11 | 555,81 | 187 994,92 | |

| Insurance funds | 74 843,40 | 482,65 | 75 326,05 | |

| Pension funds | 33 687,81 | 0,00 | 33 687,81 | |

| Investment funds | 111 961,66 | 100,00 | 112 061,66 | |

| Households** | 181 044,44 | 0,00 | 181 044,44 | |

| Non-financial corporations** | 8 030,33 | 893,68 | 8 924,01 | |

| General government institutions** | 123 674,78 | 209,58 | 123 884,36 | |

| Others | 10 150,67 | 1 469,63 | 11 620,30 | |

| Total | 1 476 255,22 | 32 404,87 | 1 508 660,09 | |

* The face value of Treasury securities located on Omnibus accounts (a form of securities register designed for non-residents) at the end of the month is included in “Foreign investors” category.

** As of September 2020, the category "households" replaced the existing category "individuals" and the category "non-financial corporations" replaced the category "non-financial entities". Domestic investors have been extended by category "General government institutions". The scope of entities included in these categories is described in the Regulation of the Minister of Finance of 8 June 2020.

Historical data are available in the file portfele.xls

Last update - 27.02.2026

Detailed information on institutional and geographical distribution of non-residents holdings is available in the following tables and in the attached files: Struktura_nierezydentów.xlsm, Nierezydenci_kraje.xlsx, Portfele_nierezydentów_po_seriach.xls. Additionally, a new category “omnibus accounts” was distinguished among foreign entities due to the fact that there is no possibility to identify investors entitled to securities registered on these accounts.

Institutional distribution of non-residents holdings in Treasury securities issued on the local market at the end of January 2026

| Institutional distribution of non-residents holdings in Treasury securities issued on the local market at the end of January 2026 (PLN million) | ||||

| T-bonds | T-Bills | Total | ||

| Banks | 15 580,67 | 435,35 | 16 016,02 | |

| Central banks | 13 914,51 | 0,00 | 13 914,51 | |

| Public institutions | 2 414,36 | 0,00 | 2 414,36 | |

| Insurance funds | 2 382,90 | 0,00 | 2 382,90 | |

| Pension funds | 19 394,15 | 0,00 | 19 394,15 | |

| Investment funds | 24 187,85 | 71,00 | 24 258,85 | |

| Hedge funds | 1 641,01 | 0,00 | 1 641,01 | |

| Households** | 653,90 | 0,20 | 654,10 | |

| Non-financial corporations** | 2 143,75 | 0,00 | 2 143,75 | |

| Others | 18 357,90 | 49,26 | 18 407,16 | |

| Total | 100 670,99 | 555,81 | 101 226,80 | |

| Omnibus accounts*** | 86 768,12 | 0,00 | 86 768,12 | |

| Non-residents total | 187 439,11 | 555,81 | 187 994,92 | |

Geographical distribution of non-residents holdings in Treasury securities issued on the local market at the end of January 2026

| Geographical distribution of non-residents holdings in Treasury securities issued on the local market at the end of January 2026 (PLN million) | ||||

| T-bonds | T-Bills | Total | ||

| Europe - eurozone | 43 438,74 | 77,21 | 43 515,95 | |

| Europe - EU non-eurozone | 2 004,30 | 71,00 | 2 075,30 | |

| Europe - non-EU | 10 179,42 | 407,60 | 10 587,02 | |

| Africa | 53,89 | 0,00 | 53,89 | |

| South America (incl. Caribbean) | 588,59 | 0,00 | 588,59 | |

| North America | 7 883,44 | 0,00 | 7 883,44 | |

| Australia and Oceania | 1 553,95 | 0,00 | 1 553,95 | |

| Asia (excl. Middle East) | 30 795,80 | 0,00 | 30 795,80 | |

| Middle East | 4 172,86 | 0,00 | 4 172,86 | |

| Total | 100 670,99 | 555,81 | 101 226,80 | |

| Omnibus accounts*** | 86 768,12 | 0,00 | 86 768,12 | |

| Non-residents total | 187 439,11 | 555,81 | 187 994,92 | |

*** Omnibus accounts – accounts run by direct participants of the National Depository (KDPW) who are not holders of securities registered on these accounts. Introduction of omnibus accounts facilitated foreign investors access to Polish Treasury securities market. Due to the previous regulations holding separate account dedicated for operations on Polish market was required which formed cost and organizational barrier.

Geographical distribution of central banks holdings in Treasury securities issued on the local market at the end of January 2026

| Geographical distribution of central banks holdings in Treasury securities issued on the local market at the end of January 2026 (PLN million) | ||||

| T-bonds | T-Bills | Total | ||

| Europe - eurozone | 0,00 | 0,00 | 0,00 | |

| Europe - EU non-eurozone | 0,00 | 0,00 | 0,00 | |

| Europe - non-EU | 0,00 | 0,00 | 0,00 | |

| Africa | 27,59 | 0,00 | 27,59 | |

| South America (incl. Caribbean) | 6,00 | 0,00 | 6,00 | |

| North America | 0,00 | 0,00 | 0,00 | |

| Australia and Oceania | 6,00 | 0,00 | 6,00 | |

| Asia (excl. Middle East) | 10 519,46 | 0,00 | 10 519,46 | |

| Middle East | 3 355,47 | 0,00 | 3 355,47 | |

| Total | 13 914,51 | 0,00 | 13 914,51 | |

Non-residents holdings in marketable T-bonds and T-bills

| Day | Non-residents holdings in marketable T-bonds and T-bills* (PLN million) | ||

| T-bonds | T-Bills | Total | |

| 02.01.2026 | 173 942,02 | 96,49 | 174 038,51 |

| 05.01.2026 | 175 747,72 | 96,49 | 175 844,21 |

| 07.01.2026 | 181 402,66 | 96,49 | 181 499,15 |

| 08.01.2026 | 180 822,94 | 96,49 | 180 919,43 |

| 09.01.2026 | 181 500,62 | 96,49 | 181 597,11 |

| 12.01.2026 | 178 453,89 | 96,49 | 178 550,38 |

| 13.01.2026 | 181 693,59 | 106,49 | 181 800,08 |

| 14.01.2026 | 181 881,68 | 106,49 | 181 988,17 |

| 15.01.2026 | 183 547,36 | 106,49 | 183 653,85 |

| 16.01.2026 | 182 311,83 | 106,49 | 182 418,32 |

| 19.01.2026 | 182 108,61 | 148,11 | 182 256,72 |

| 20.01.2026 | 184 951,30 | 555,31 | 185 506,61 |

| 21.01.2026 | 185 460,47 | 555,31 | 186 015,78 |

| 22.01.2026 | 186 978,45 | 555,81 | 187 534,26 |

| 23.01.2026 | 183 562,28 | 555,81 | 184 118,09 |

| 26.01.2026 | 185 890,18 | 555,81 | 186 445,99 |

| 27.01.2026 | 187 018,32 | 555,81 | 187 574,13 |

| 28.01.2026 | 186 365,88 | 555,81 | 186 921,69 |

| 29.01.2026 | 184 474,32 | 555,81 | 185 030,13 |

| 30.01.2026 | 186 830,03 | 555,81 | 187 385,84 |

Historical data are available in the file nierezydenci.xls

Last update - 27.02.2026

Materials

Nominal T-bonds and T-bills issued on the domestic marketPortfele01.xls 0.60MB Nominal T-bonds issued on the domestic market by series

Portfele_po_seriach01.xls 2.62MB Nominal T-bonds issued on the domestic market held by non-residents by series

Portfele_nierezydentow_po_seriach01.xls 2.62MB Institutional and geographical distribution of non-residents' holdings in Treasury Securities issued on the domestic market

Struktura_nierezydentow01.xlsm 0.48MB Non-residents' holdings in marketable T-bonds and T-bills

Nierezydenci_01.xls 0.51MB Non-residents' holdings in Treasury Securities issued on the domestic market by countries

Nierezydenci_kraje01.xlsx 0.32MB

- Last updated on:

- 27.02.2026 15:05 Anna Czarnecka

- First published on:

- 31.07.2019 15:02 Anna Czarnecka